Technical analysis, ever noticed the term? It’s a game-changer in the trading world. Essentially, it’s about deciphering market vibes through price patterns and volume data. Think of it as the crystal ball of trading. It arms traders with insights, helping them make savvy decisions. Now, let’s get a niche.

This article dives deep into the shimmering realm of gold trading, guided by the compass of technical analysis.

And guess what? We’ll sprinkle in some wisdom from the oil trading scene too. Ready to unlock some golden insights?

Unveiling Technical Analysis

Technical analysis actively reads historical price data to forecast upcoming price movements. It delves deep into past market behaviors, hunting for patterns that might indicate future trends. More than just charts, it acts as a trader’s roadmap. Using these decoded patterns, traders design strategies specific to various markets.

If you are navigating stock volatility or riding the forex waves, technical analysis anchors trading decisions in past insights. It directly connects data-driven knowledge with practical trading strategies.

Top 5 Gold trading tips

Trading gold can be a profitable but volatile endeavor. Here are five gold trading tips to help you navigate the world:

- Understand the Fundamentals

Before you start trading gold, it’s essential to understand the fundamental factors that influence its price. These include economic data, geopolitical events, interest rates, and inflation. Keep an eye on news and economic indicators that can impact the supply and demand for gold.

- Technical Analysis

Utilize technical analysis to identify trends and potential entry and exit points. Common technical indicators for gold trading include moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). These tools can help you make informed decisions based on historical price patterns.

- Risk Management

Gold trading can be highly volatile, so it’s crucial to manage your risk. Set stop-loss orders to limit potential losses and stick to a risk-reward ratio that suits your trading strategy. Never risk more than you can afford to lose, and consider using position sizing techniques to protect your capital.

- Diversify Your Portfolio

Don’t put all your eggs in one basket. Gold can be a valuable addition to a diversified investment portfolio, but don’t rely solely on it. Spread your investments across different asset classes to reduce risk.

- Stay Informed

Stay updated with the latest news and developments that could impact the gold market. Follow trusted financial news sources and consider joining online forums or communities of gold traders to share insights and stay informed about market sentiment.

Key Technical Analysis Tools in Gold Trading

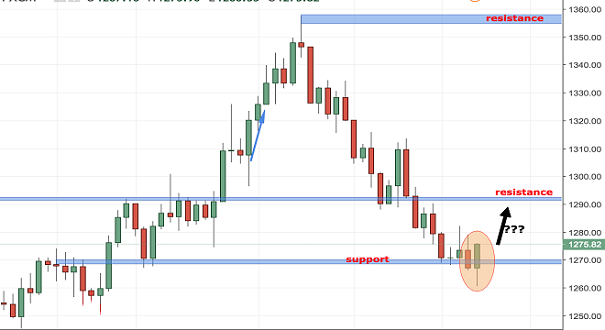

When diving into the intricate world of gold trading, three essential technical analysis tools stand out: trendlines, moving averages, and candlestick patterns.

Trendlines serve as the market’s diary, drawing its highs and lows, and mapping out its direction. They give traders a bird’s eye view of where gold has been and, potentially, where it might head next.

Moving averages, on the other hand, smooth out price data to create a single flowing line, which makes it easier to identify the direction of the trend. Whether you’re looking at a 50-day or a 200-day moving average, this tool is pivotal in spotting potential buy or sell signals in the gold market.

Lastly, candlestick patterns are like the market’s Morse code. These formations, originating from Japanese rice traders centuries ago, give deep insights into market psychology and potential future price movements.

Application of Technical Analysis to Gold Trading

Gold, often heralded as both a store of value and a safe-haven asset, dances to its unique rhythm in the financial markets. But with the right tools, its movements become less mystifying. Let’s explore how trendlines, moving averages, and candlestick patterns unlock this dance.

Trendlines in gold trading plot the metal’s emotional journey. When gold prices test a trendline multiple times, it indicates a significant level of support or resistance. Given gold’s stature as a store of value, these trendlines often represent collective global sentiments about economic stability or turmoil.

Moving averages provide a smoothed perspective on gold’s price action. When gold’s price crosses above a moving average, it can signal a bullish trend, perhaps indicating rising demand for this safe-haven asset. Conversely, a downward cross might suggest a bearish sentiment or a shift to riskier assets.

Candlestick patterns in gold trading are especially potent. These patterns, like the bullish engulfing or the evening star, can hint at rapid sentiment shifts. Given the weighty role gold plays in portfolios as a hedge against uncertainty, these patterns can offer a sneak peek into global economic sentiments and potential policy shifts.

Correlation with Oil Trading: Interplay of Analysis

Both oil and gold rely on technical analysis tools like trendlines, moving averages, and candlestick patterns for decoding price trends. In oil trading, these tools actively highlight energy demand, geopolitical changes, and OPEC decisions. Meanwhile, in gold trading, they pinpoint economic well-being and global feelings.

Meanwhile gold reflects monetary strategies and global security, oil responds to supply-demand balances and immediate geopolitical events.

Despite these market differences, traders universally apply technical analysis, showcasing its consistent effectiveness from the gleam of gold to the dynamics of oil.

Predicting Oil Prices: Leveraging Technical Analysis

Predicting oil prices can feel like a maze, but technical analysis lights the way. Oil Price Forecast actively tracks oil’s historical journey, identifying pivotal resistance and support zones that might shape future prices. Moving averages streamline fluctuating price data, underscoring prevailing trends and suggesting momentum shifts.

For the moment, candlestick patterns instantly signal upcoming market shifts, showing short-term sentiments and possible price turns. Together, these tools turn the intricate oil market narratives into clear forecasts, helping traders navigate the dynamic energy terrain.

Balancing Technical Analysis and Fundamental Factors

Marrying technical analysis with fundamental factors creates a holistic trading strategy. While technical tools chart the historical and current price movements, fundamental analysis delves into the ‘why’ behind those moves.

For gold traders, economic data, interest rates, and geopolitical events aren’t just news headlines; they directly influence gold’s appeal as a store of value or a safe-haven asset. A spike in interest rates might dim gold’s allure, while geopolitical tensions often boost its demand.

Similarly, oil traders balance their technical insights with real-world events like OPEC decisions, supply disruptions, or global energy policies.

In essence, combining the predictive prowess of technical analysis with the depth of fundamental factors ensures traders aren’t just reacting to the market’s pulse but truly understanding its heartbeat.

Challenges and Limitations: Navigating Complexities

Over Reliance on Technical Analysis: Relying solely on technical analysis can be a pitfall. While it offers valuable insights based on past price movements, it doesn’t always account for sudden, unforeseen market events.

Gold Trading Challenges: Following are some issues you may face

- Black Swan Events: Unexpected global occurrences, like political upheavals or pandemics, can drastically sway gold prices, rendering technical predictions ineffective.

- Central Bank Actions: Unanticipated moves by central banks, like large-scale gold sales or purchases, can challenge the accuracy of technical indicators.

Oil Trading Challenges:

- Geopolitical Disruptions: Sudden geopolitical events, such as wars or sanctions in oil-producing regions, can cause immediate and unpredictable price swings, making technical predictions less reliable.

- Supply Chain Disruptions: Unexpected events, like natural disasters affecting oil infrastructure, can alter supply dynamics overnight, challenging the validity of technical forecasts.

Continuous Learning and Market Adaptation

- Evolving Market Dynamics

Markets are living entities, continuously changing and evolving. What worked yesterday might not necessarily work tomorrow. Staying attuned to these shifts is essential.

- Refining Technical Analysis Skills

While the basics of technical analysis remain constant, its application must be refined and recalibrated. Continuous education, attending workshops, and following market experts can sharpen these analytical tools.

- Gold and Oil Trading Nuances

Each market has its nuances. For instance, a pattern that emerges in gold trading might not play out the same way in oil. Hence, understanding and adapting to each market’s idiosyncrasies is vital.

- Adaptable Strategies

Rigid strategies can often backfire. Embracing flexibility, testing, and tweaking approaches based on real-time data and market feedback can optimize trading outcomes.

- Feedback Loop

After every trade, review outcomes against predictions. Understanding where predictions went right, or wrong, can provide invaluable learning for future trades.

In essence, the trading realm is not for the complacent. Successful traders are always curious, continuously adapt, and recognize that every market hiccup, whether a stumble or a leap, offers a lesson.

Conclusion

Technical analysis stands as a universal language, resonating with traders globally. Charting the dynamics of gold or decoding oil’s volatility, its principles consistently shine through. We’ve emphasized merging technical insights with real-world events and the need for adaptability in shifting markets. Despite unique nuances in each asset class, technical analysis remains a consistent, guiding tool. It not only deciphers market trends but also paves the path for informed, profitable decisions. In the vast seas of trading, it serves as the North Star, guiding traders across various terrains.